Getting Pinged by the Future - A dive into Ping An Insurance Group

- ALEX NEAMTIU

- Sep 8, 2021

- 7 min read

Updated: Sep 22, 2021

Summary

Trading at 51.5% below our estimate of its fair value

Earnings have grown 17.8% per year over the past 5 years

Trailing dividend yield of 4.52%

Leading the technological disruption of the global insurance market with a diversified portfolio of financial services as well as complementary business lines.

Company description

Based in Shenzhen, China, Ping An Insurance (Group) Company of China, Ltd. is a leading financial institution providing financial products and services for insurance, banking, asset management, and fintech and healthtech businesses in the People’s Republic of China. The company was founded in 1988 and has been at the forefront of China’s transition to a market economy being the first joint-stock company and issuing the first individual life-insurance policy in the country. The name of the company "Ping An" literally means "safe and well".

Ping An Insurance consistently ranks as one of the world's top global insurance brands, and is considered to be China's biggest insurer, with US$110 billion in net premiums written in 2019. Its market capitalization is at US$217 billion in March 2021, making it the largest insurer in Asia-Pacific. With over 218 million retail customers and 598 million Internet users, Ping An is also one of the largest financial services companies in the world.

In recent years, Ping An has been a leader in the financial field in the number of technology patent applications. Furthermore it has received multiple awards in a number of technology sectors, including AI and blockchain.

Ping An is a publicly listed company with its shares traded since 2004 on the Hong Kong Stock Exchange and subsequently also listed in Shanghai in 2007.

Business overview

The company operates through 7 main segments:

Life and Health Insurance segment

Services: term, whole-life, endowment, annuity, investment-linked, universal life, and health care and medical insurance to individual and corporate customers.

Property and Casualty Insurance segment

Services: auto, non-auto, and accident and health insurance to individual and corporate customers.

Banking segment

Services: loan and intermediary businesses with corporate and retail customers; and offers wealth management and credit card services to individual customers.

Trust segment

Services: trust services and investing activities.

Securities segment

Services: offers brokerage, trading, investment banking, and asset management services.

Other Asset Management

Services: investment management, finance lease, and other asset management services.

Technology segment

Services: financial and daily-life services through internet platforms, such as financial transaction information service platform, and health care service platform. It also provides annuity insurance, investment management, IT and business process outsourcing, real estate investment, futures brokerage, consulting, project investment, financial advisory, currency brokerage, property agency, fundraising and distribution, real estate development and leasing, and insurance agency services.

Investment Case

Valuation

The company has been consistently profitable over the past 5 years generating healthy free cash flows and double digit profit margins in the past 3 years, above industry average. The company’s financials have been fairly steady and predictable over the analyzed period.

Source: Simply Wall St.

The implied valuation using a discounted cash flow approach suggests that at the current trading price of HK$60.35, the company is severely undervalued, thus offering significant margin of safety along with a generous upside potential.

Source: Simply Wall St.

Even when compared to its global peers, the company presents a great relative value opportunity, trading at a lower PE, PS and PB than its peers.

Source: Gurufocus

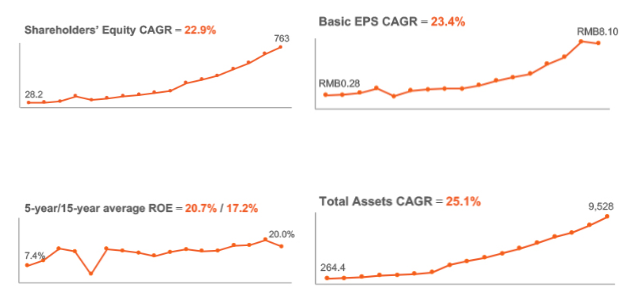

Performance

The company’s earnings have grown at 17.8% per year over the past year, and the pace is expected to continue at double digit rates over the coming period as it seeks to become a “world-leading” insurer. Historically, the company’s leadership views its development in 3 distinct stages. The first, a foundational stage, when the company drew on the Taiwanese insurance business model which was itself based on Western models which were adapted for the particularities of local culture. The second stage was one of “internationalization” where international insurers entered the Chinese market, thus creating a more competitive market, boosted by the economic growth and rising standards of living. Currently the company is entering a third stage where it is creating an innovative made-in-China approach to developing life insurance, leveraging international best practices and the advent of technology and AI.

The company’s current ROE stands at 14.7% which puts it well above the 11.1% for the industry.

Source: Ping An Life Co

Dividend

At the time of writing the company offers a dividend of 4.52 % which is above the industry average of 4% and represents a reasonably low payout ratio of 30.4% indicating that the dividends are well covered by earnings with no reason for future dividends to be reduced.

Historically the company has been consistently increasing the amount of dividends it pays out and the trend is expected to continue in the near future.

Source: Simply Wall St.

Financial Health

There are currently no perceived leverage concerns with the company’s interest on its debts being well covered by EBIT at 7.2x coverage. Debt-to-operating cash flow remains fairly high but in line with industry practice at 8X. On August 16, 2021, Moody affirmed the A2 insurance financial strength rating of Ping An Life Insurance Company of China. The outlooks remain stable. The rating is based on the company having maintained good profitability and a solid capitalization, with a high-value product mix that supports its internal capital generation capacity. The strengths are somewhat offset by Ping An Life’s rising asset risk with significant exposure to equity and alternative investments relative to its capital, which can translate into volatility both in its earnings and its equity portfolio. Also of particular concern is exposure to credit stress in China Fortune Land Development Co., Ltd.

X-Factor

Ping An is currently the highest-valued insurance brand in the world, according to Brand Finance’s 2021 report.

Over the past decade, Ping An has invested heavily in technology to increase its global competitiveness. According to the insurer, it has filed over 32,000 applications for technology patents, ranging from medical technology to financial technology and beyond.

For its life insurance business, Ping An has established an AI-powered database known as AskBob, which acts as a smart training platform for agents’ continued learning, helping them to strengthen overall capabilities. In 2020, its smart insurance tool generated over RMB15 billion (SG$3.11 billion) in written premiums.

For its car insurance business Ping An has deployed AI technology across the whole process of claims settlement, including initial reporting, submitting digital pictures, loss assessment and document handling. For 30% of the cases AI image recognition technology is used to complete the loss assessment with an accuracy rate as high as 95% and compensation can be received within seconds.

The examples where AI is deployed are numerous which lead to increased speed for transacting, lower costs and increased customer satisfaction. The company’s inroads into fintech is so accentuated that several of its tech offerings are being offered to other financial institutions as well. Since COVID broke, it has provided 60 banks with remote sales-management and customer-support tools, including an AI voice robot and videoconferencing app.

In the context of today’s markets where inflation is a looming factor, the insurance / banking business provides an interesting natural hedge against rising prices. With lower real currency life insurance claims paid in the future and yearly adjustments to the health insurance premiums evolving with market conditions, the company is well set up to weather any inflationary pressures. Furthermore the balance sheet of the company is positioned for this type of environment, with liabilities that will be reduced by a rise in prices and / or interest rates and with assets that will be less affected by these factors as they materialize. As at June 30, 2021, the company’s investment portfolio of insurance funds consisted of:

2.1 % Cash & equivalents,

5.8% Term deposits,

72% Debt financial assets

7.9% Stocks

2.3% Equity funds

9.3% Equity type investments and investment properties

In short, the company maintains a 80% debt / 20% equity portfolio which could provide adequate downside protection in the eventuality the current low interest / high inflation environment persists but also a modest upside should the situation start to revert to historical means.

Conclusion

Ping An offers a unique blend of characteristics that could make it a worthy investment under the current market conditions:

The appeal of a fin-tech leader with enhanced AI capabilities, double digit growth and an ecosystem that encapsulates all of the main features expected from a financial institution.

The company is investing heavily into AI health applications which can significantly reduce costs and errors and expedite processes, while making the experience more pleasant and hassle-free for its clients

The lean cost structure and tech benefits materialize in above average financial performance which is expected to continue over the coming period.

Attractive valuation with low multiples, high profitability and great growth prospects

Market leader in a field that is ripe for both disruption and consolidation

While the prospects of the company make it a compelling business case, it is important to also weigh them against any risks the company may face in the current market context. Technological advancement may pose significant threats related to privacy issues, especially as they concern health and financial information of a large portion of the Chinese population. In addition, security of information remains primordial with any breaches posing a meaningful threat to the viability of the system. Finally, regulatory actions by the Chinese government may impact operations and future growth, however any such actions could also play out in favour of the company.

Disclaimer

This article by Cozar Investments is general in nature. We provide commentary and content that is educational in nature which is based on historical data, analyst forecasts using an unbiased methodology and multiple other sources. Our articles are not intended to be financial advice but rather to provide market commentary. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. To assess the suitability and merits of any investment opportunity we encourage to consult your financial advisors as the situation warrants it. We aim to bring you long-term focused analysis driven by fundamental data. While we make every effort to ensure the accuracy of the information presented using only sources we believe to be reliable, please take note that this analysis may not incorporate the latest price-sensitive company announcements, quantitative or qualitative material and we provide no representation or warranty, expressed or implied with respect to the accuracy of the material.

You should assume that Cozar Investments or the Author of the article holds positions in any of the securities discussed herein. Cozar Investments is not receiving compensation for the article other than from ad services displayed on the page. Neither Cozar Investments nor the Author have any business relationship with any companies whose securities are mentioned in this article.

Comments